India took a significant step forward in strengthening its position as a global financial leader at the Global Fintech Fest 2025 held in Mumbai. The event brought together fintech innovators, investors, regulators and global industry leaders, and served as the stage for two major announcements that could reshape India’s financial landscape.

Finance Minister Nirmala Sitharaman launched a new Foreign Currency Settlement System (FCSS) at GIFT City and highlighted that India now accounts for nearly half of the world’s real-time digital transactions. These developments demonstrate how quickly India is advancing not just as a digital payments powerhouse but also as an emerging global financial hub.

The Foreign Currency Settlement System (FCSS)

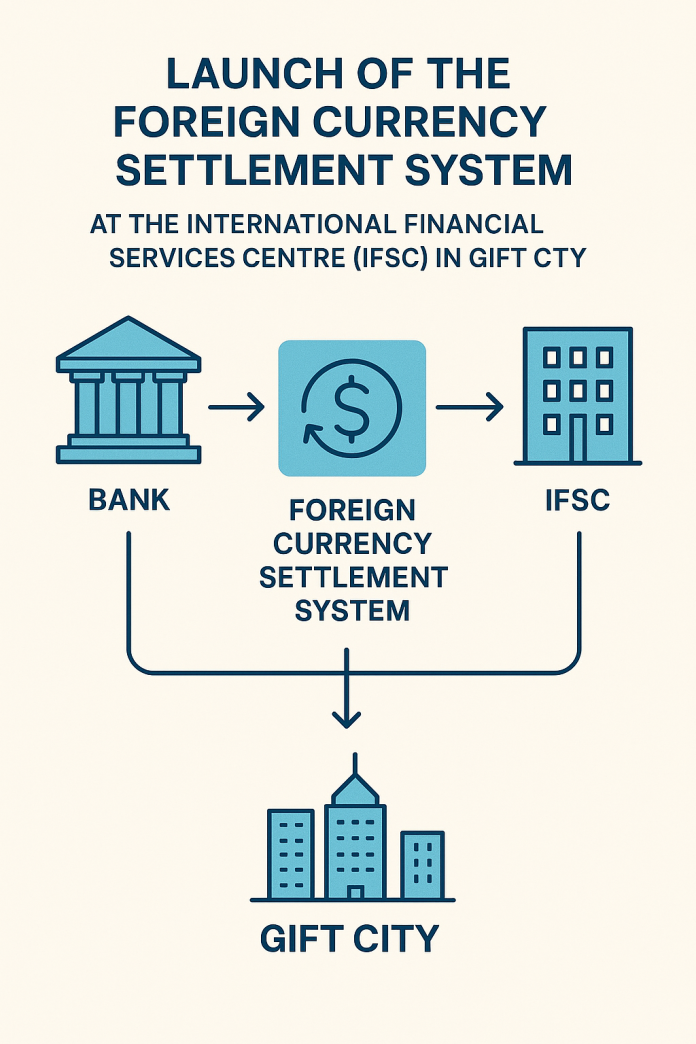

One of the biggest takeaways from the event was the launch of the Foreign Currency Settlement System at the International Financial Services Centre (IFSC) in GIFT City.

Until now, foreign currency transactions processed at IFSC largely depended on international correspondent banks. This older process was slow, often taking anywhere between 36 to 48 hours, because multiple intermediaries were involved.

The newly introduced FCSS aims to change this completely.

With FCSS, foreign currency transactions can now be settled in real time or near-real time. This drastically improves efficiency, reduces settlement risks, minimizes delays and lowers costs for businesses operating across borders.

This new system places GIFT City in the same league as prominent global financial centres such as Hong Kong, Tokyo and Singapore, all of which have local-currency settlement capabilities. For India, this is more than just a technological upgrade; it’s a strategic move that strengthens the country’s ambition to become a competitive global financial hub.

The platform is designed with stringent security frameworks, modern messaging standards and real-time gross settlement features, ensuring seamless and transparent cross-border financial activity.

India Dominates the Global Real-Time Payments Space

Another significant highlight at the event was India’s staggering progress in digital payments.

The Finance Minister announced that India now accounts for about 50% of the world’s real-time digital transactions. This means half of all instantaneous digital payments happening across the globe are processed in India, a statistic that firmly places the country at the top of the global fintech ecosystem.

The widespread adoption of digital payment platforms such as UPI, along with advanced API-based banking systems, mobile wallets, and innovative fintech applications, has transformed how people transact across the country.

What stands out most is that digital payments in India are no longer restricted to big cities. Small towns, rural regions and remote areas have adopted digital payments with equal enthusiasm. This deep penetration has not only made everyday transactions easier but has also enhanced financial inclusion, transparency and accountability in both the public and private sectors.

The scale of this adoption is now being recognized globally, reinforcing India’s reputation as the world’s fastest-growing digital payments market.

How These Announcements Reshape India’s Financial Ecosystem

1. Faster & More Efficient Global Transactions

With FCSS, businesses and individuals can carry out cross-border transactions much faster. Instead of waiting up to two days for settlements, payments can go through in seconds. This improvement helps businesses manage cash flow better and reduces operational friction.

2. Boost for GIFT City

The introduction of FCSS significantly strengthens GIFT City’s appeal to global investors. With modern and efficient settlement mechanisms in place, more foreign companies, fintech firms and financial institutions are likely to consider GIFT City as a preferred base for their international operations.

3. Stronger Fintech Innovation

The government has made it clear that innovation must continue, but responsibly. The new settlement system, along with India’s strong digital-payment infrastructure, creates a supportive environment for fintech companies to build trustworthy, scalable and impactful financial products.

4. Financial Inclusion at a New Level

Digital payments are no longer a luxury; they have become a part of everyday life for millions. The combination of real-time settlement, secure platforms and wide accessibility means India is moving towards deeper financial participation for all sections of society.

5. Attractive to Global Investors

India’s improved payment ecosystem, reduced settlement risks and faster processing capabilities make the country an attractive destination for foreign investment. As a result, India’s financial markets could see increased participation from global investors.

Government’s Call to Fintech Players

During her address, the Finance Minister outlined some key expectations for the fintech sector:

- Innovation must be responsible – Companies must adopt strong risk-management practices, especially with increasing use of AI and automation.

- Technology should empower, not complicate – Systems must remain simple, effective and accessible.

- Security and customer protection remain top priorities – As fintech grows rapidly, safeguarding consumer data and privacy is essential.

- Inclusion must be at the center – The government expects fintech players to create products that benefit every segment of society, not just urban consumers.

These directives show the government’s focus on building a sustainable and trustworthy ecosystem where innovation and regulation move in harmony.

A Strong Outlook for India’s Fintech Future

The announcements at Global Fintech Fest 2025 paint a promising picture for India’s financial future.

With FCSS enabling faster settlement, India is positioning itself as a serious contender in global finance. Similarly, the dominance in real-time digital transactions shows how deeply digital payments are integrated into everyday life.

Looking ahead, the impact of these developments could include:

- More multinational companies setting up operations in GIFT City

- Fintech firms exploring new use-cases in cross-border payments

- Increased global investment in India’s financial sector

- Further expansion of digital financial services into rural markets

- Stronger collaboration between regulators and fintech innovators

India’s fintech journey has come a long way. And with these new initiatives, the country is no longer just participating in global financial trends, it is shaping them.

Conclusion

The Global Fintech Fest 2025 highlighted India’s rapid transformation in the digital finance space. With the launch of the Foreign Currency Settlement System and the country’s growing dominance in real-time transactions, India is signaling a new era of financial innovation, efficiency and global competitiveness.

As India continues to build modern, secure and inclusive financial systems, it is well on its way to becoming one of the world’s leading fintech hubs, a future that seems closer than ever.